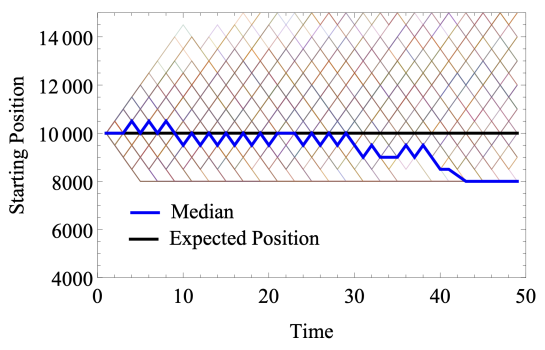

The concept of applied ergodicity addresses how averages across time and across a population relate in practical settings. Many systems in economics, finance, and even personal decision-making are often assumed to be ergodic — meaning that an individual's time-averaged outcomes are representative of the average outcomes across a whole population. However, this assumption usually doesn't hold in real-world scenarios. In this project, we focus on identifying when and why this discrepancy occurs, leveraging concepts from ergodic theory to understand the implications of non-ergodicity. Our goal is to help design economic models and reinforcement learning methods, more in tune with the individuals and their experiences, by focusing on time averages rather than ensemble averages.

Papers

PRESENTATIONS

The influence of ergodicity on risk affinity

Arne Vanhoyweghen, Cathy Macharis & Vincent Ginis

Presented at the ERGODICITY ECONOMICS 2021 ONLINE CONFERENCE.